A state administrative law judge is taking official judicial notice of a federal Department of Labor letter that strips the American Labor Alliance of its union designation. ALA officials are crying foul. ALA’s attorney and CEO continue to assert that the DOL letter could be a fake.

It is no fake

DOL officials have positively confirmed to Workers’ Comp Executive not only that the letter is real but that ALA’s union file number is no longer active. “Per the letter that you have a copy of, OLMS has determined that the ALA is not a labor organization within the meaning of the LMRDA, and has therefore terminated its file,” DOL’s Michael Trupo in Washington exclusively tells Workers’ Comp Executive.

American Labor Alliance, which also operates as Agricultural Contracting Services Association (AGSA), is the organization marketing a self-proclaimed alternative to workers’ comp insurance in violation of multiple cease and desist orders issued by the California Department of Insurance. CDI says the company’s CompOneUSA product is not valid workers’ comp coverage and that employers who bought it do not have coverage. The company also said under oath that it has no reinsurance, no excess insurance and is paying workers’ comp claims out of its current cash flow.

The organization launched a wide-ranging attack on the Feb. 23, 2017, letter from DOL’s Larry King to Marcus Asay at American Labor Alliance. Asay is the organization’s chief executive officer.

“A Serious Affair”

“This is clearly a serious affair. AGSA as a business and as a union is under attack. An adverse ruling could put them out of business,” says ALA attorney Charles Manock in a filing with the Department’s administrative hearing bureau. The hearing bureau is currently handling ALA’s appeal of the Department’s cease and desist order. “The [DOL] Letter is not evidence which should be considered because Respondents have had no opportunity to refute it, put it in context or test its sufficiency. The lack of opportunity to explore the source, authenticity, and meaning of the document does not even come close to the level of evidence on which responsible persons are accustomed to rely[ing] in the conduct of serious affairs.”

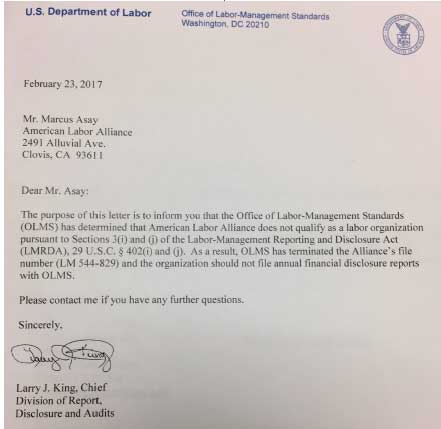

The letter in question (see photo) is written on Department of Labor letterhead and is signed by the chief of its Division of Report, Disclosure, and Audits. It states: “The purpose of this letter is to inform you that the Office of Labor-Management Standards (OLMS) has determined that American Labor Alliance does not qualify as a labor organization pursuant to Sections 3(i) and (j) of the Labor-Management Reporting and Disclosure Act (LMRDA), 29 U.S.C. Section 402(i) and (j). As a result, OLMS has terminated the Alliance’s file number (LM-544-829), and the organization should not file annual financial disclosure reports with OLMS.”

The letter in question (see photo) is written on Department of Labor letterhead and is signed by the chief of its Division of Report, Disclosure, and Audits. It states: “The purpose of this letter is to inform you that the Office of Labor-Management Standards (OLMS) has determined that American Labor Alliance does not qualify as a labor organization pursuant to Sections 3(i) and (j) of the Labor-Management Reporting and Disclosure Act (LMRDA), 29 U.S.C. Section 402(i) and (j). As a result, OLMS has terminated the Alliance’s file number (LM-544-829), and the organization should not file annual financial disclosure reports with OLMS.”

The letter lists ALA’s address, but the organization claimed under penalty of perjury that it never received the letter. The organization also argues that “The subject letter, especially with no authentication, is hearsay and should not be used for any findings in the serious matter.”

ALJ Kristin Rosi is expected to issue a decision on the organization’s appeal later this year. The latest dispute over the DOL letter is expected to be fodder for a future appeal to state court if that ruling goes against the organization.

In the meantime, hundreds of California employers may still be operating under agreements they signed with ALA over the past year that they believe offer workers’ comp coverage, but which the CDI says is invalid.

State officials maintain that the “benefits” ALA provides are not the required statutory insurance coverage, and legal experts say these employers may not have the protection of California’s sole and exclusive remedy law. Injured workers, therefore, can bring damages cases against employers. Such claims are excluded from all Commercial General Liability policies, say experienced brokers.

And the California Department of Insurance say brokers selling the product may be subject to serious official actions.