Over the last few years, Providence Publications has been recognized for journalistic excellence by three of the major trade associations. The Newsletter on Newsletters, the Society of Professional Journalists (SPJ), and the Specialized Information Publishers Association (SIPA)have recognized Workers’ Comp Executive and Cal-OSHA Reporter for their work in numerous categories including government service, public service, and breaking news.

2013

When the Senate Rules Committee conducted a confirmation hearing for Department of Industrial Relations Director Christine Baker and Division of Workers’ Compensation Administrator Rosa Moran, Workers’ Comp Executive brought cameras to the hearing room. Capitol Correspondent Bess Shapiro provided the wind up with the Capitol Building as a backdrop before moving to the hearing room to capture the action. Using two cameras, Workers’ Comp Executive’s video team filmed both the nominees and the committee members.

When the Senate Rules Committee conducted a confirmation hearing for Department of Industrial Relations Director Christine Baker and Division of Workers’ Compensation Administrator Rosa Moran, Workers’ Comp Executive brought cameras to the hearing room. Capitol Correspondent Bess Shapiro provided the wind up with the Capitol Building as a backdrop before moving to the hearing room to capture the action. Using two cameras, Workers’ Comp Executive’s video team filmed both the nominees and the committee members.

Combining Bess Shapiro’s narration with the seamless splicing together of important video clips, Workers’ Comp Executive was able to capture the essence of a two hour long confirmation hearing in a four and a half minute segment.

Reporter: Bess Shapiro

Video staff: Robbie Lynn, Nick Hurley, Cameron Congdon

Title: And the Ayes Have It

Contest: Specialized Information Publishers Association

Category: Best Use of Video

Place: 3rd

Following a rash of worker deaths and injuries in confined spaces California’s Division of Occupational Safety and Health (DOSH) launched a special emphasis program and Cal-OSHA Reporter brought out the cameras to bring the news to subscribers. Cal-OSHA Reporter’s crack video team shot live interviews of experts as DOSH and the Oakland Fire Department teamed up to demonstrate confined space hazards, prevention techniques and the importance of rescue plans.

Following a rash of worker deaths and injuries in confined spaces California’s Division of Occupational Safety and Health (DOSH) launched a special emphasis program and Cal-OSHA Reporter brought out the cameras to bring the news to subscribers. Cal-OSHA Reporter’s crack video team shot live interviews of experts as DOSH and the Oakland Fire Department teamed up to demonstrate confined space hazards, prevention techniques and the importance of rescue plans.

Breaking down the interviews, reporter Kevin Thompson and the Cal-OSHA Reporter’s video staff put together the most important segments of expert interviews with the Oakland Fire Department demonstrations serving as a backdrop. Kevin’s detailed coverage combined with the relative footage of experts and live demonstrations provided an informative video package for Cal-OSHA Reporter subscribers on an important topic.

Reporter: Kevin Thompson

Video staff: Robbie Lynn, Nick Hurley, Cameron Congdon

Title: Widess: There is No Room for Error

Contest: Specialized Information Publishers Association

Category: Best Use of Video

Place: 2nd

2012

Following a rash of worker deaths and injuries in confined spaces California’s Division of Occupational Safety and Health (DOSH) launched a special emphasis program and Cal-OSHA Reporter brought out the cameras to bring the news to subscribers. Cal-OSHA Reporter’s crack video team shot live interviews of experts as DOSH and the Oakland Fire Department teamed up to demonstrate confined space hazards, prevention techniques and the importance of rescue plans.

Breaking down the interviews, reporter Kevin Thompson and the Cal-OSHA Reporter’s video staff put together the most important segments of expert interviews with the Oakland Fire Department demonstrations serving as a backdrop. Kevin’s detailed coverage combined with the relative footage of experts and live demonstrations provided an informative video package for Cal-OSHA Reporter subscribers on an important topic.

Reporter: Kevin Thompson

Video staff: Robbie Lynn, Nick Hurley, Cameron Congdon

Title: Widess: There is No Room for Error

Contest: Specialized Information Publishers Association

Category: Best Use of Video

Place: 2nd

2012

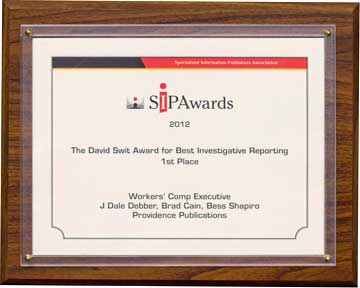

State Compensation Insurance Fund, California’s quasi-public workers’ comp carrier of last resort, announced a $50 million dividend for its policyholders. The rules for SCIF dividends are different, yet it announced some specific criteria to comply that discriminated against policy holders. The rules for SCIF dividends are different. Workers’ Comp Executive was the only industry publication to recognize a problem and let loose with a well sourced and well researched story. State Fund can issue a dividend but it needs to be fair in its approach. Under the regulation State Fund’s plan was illegal. Despite a clear violation of statute this was an oversight that apparently even escaped State Fund’s lawyers. The result was an instant reversal on the part of State Fund. It called an emergency public meeting to announce the changes to its proposed dividend plan to make it compliant with the law.

State Compensation Insurance Fund, California’s quasi-public workers’ comp carrier of last resort, announced a $50 million dividend for its policyholders. The rules for SCIF dividends are different, yet it announced some specific criteria to comply that discriminated against policy holders. The rules for SCIF dividends are different. Workers’ Comp Executive was the only industry publication to recognize a problem and let loose with a well sourced and well researched story. State Fund can issue a dividend but it needs to be fair in its approach. Under the regulation State Fund’s plan was illegal. Despite a clear violation of statute this was an oversight that apparently even escaped State Fund’s lawyers. The result was an instant reversal on the part of State Fund. It called an emergency public meeting to announce the changes to its proposed dividend plan to make it compliant with the law.

Reporters: J Dale Debber, Brad Cain, Bess Shapiro

Title: Is State Fund’s Dividend Plan Illegal?

Contest: Specialized Information Publishers Association

Category: David Swit Award for Best Investigative Reporting

Place: 1st

State Fund Declares Dividend

Is State Fund Dividend Plan Illegal

State Fund Fixes Dividend Policy

When the staff of the Workers’ Compensation Insurance Rating Bureau of California wanted to change a rule that could potentially undermine efforts to combat this kind of fraud, Workers’ Comp Executive was there to tell small employers that WCIRB wanted to remove one of the more effective tools for fighting fraud. One of the biggest areas of premium fraud is in the construction industry. For this reason WCIRB requires that any workers’ comp policy generating exposure in a high wage construction classification have a physical audit, regardless of the amount of premium. WCIRB proposed to do away with this important check on the construction industry and make it uniform with other policies. Brad’s coverage showed that under cover of some other business, WCIRB tried to sneak in the change to the audit rule. When it failed before its own committee, the staff backed off and took another look.

When the staff of the Workers’ Compensation Insurance Rating Bureau of California wanted to change a rule that could potentially undermine efforts to combat this kind of fraud, Workers’ Comp Executive was there to tell small employers that WCIRB wanted to remove one of the more effective tools for fighting fraud. One of the biggest areas of premium fraud is in the construction industry. For this reason WCIRB requires that any workers’ comp policy generating exposure in a high wage construction classification have a physical audit, regardless of the amount of premium. WCIRB proposed to do away with this important check on the construction industry and make it uniform with other policies. Brad’s coverage showed that under cover of some other business, WCIRB tried to sneak in the change to the audit rule. When it failed before its own committee, the staff backed off and took another look.

Reporter: Brad Cain

Title: Is WCIRB Aiding Premium Fraud?

Contest: Specialized Information Publishers Association

Category: Best Spot News

Place: 1st

State Compensation Insurance Fund, a quasi-public agency and the largest workers’ comp carrier in California embarked on a reorganization plan that involved downsizing and relocating personnel. Rather than using video cameras to cover a lengthy, pro forma SCIF board meeting, editor Brad Cain decided to get right to the heart of matter and shoot the protest then going outside SCIF headquarters.

State Compensation Insurance Fund, a quasi-public agency and the largest workers’ comp carrier in California embarked on a reorganization plan that involved downsizing and relocating personnel. Rather than using video cameras to cover a lengthy, pro forma SCIF board meeting, editor Brad Cain decided to get right to the heart of matter and shoot the protest then going outside SCIF headquarters.

As revealed during Brad’s coverage, SCIF employees fear being uprooted and relocated only to be laid off later. Brad not only captured the protest, he interviewed concerned employees and drew contrasts between their plight and those of the Occupy protests going on at the time.

Reporter: Brad Cain

Title: State Fund Workers Protest Cuts

Video Team: Robbie Lynn, Cameron Congdon

Category: Best Use of Video

Place: 1st

2011

Looking for a way to capture the talent, expertise and influence of the numerous individuals in the California workers’ comp industry, Workers’ Comp Executive started by compiling a list of names in several different categories and then came up with a list of questions to ask each and every one of them. What emerged was a comprehensive product of the Who’s Who in workers’ compensation. The Most Influential didn’t just list a name and an affiliation; it gave answers to some of the most pressing California workers’ comp questions of the time and provided a glimpse into the future.

Looking for a way to capture the talent, expertise and influence of the numerous individuals in the California workers’ comp industry, Workers’ Comp Executive started by compiling a list of names in several different categories and then came up with a list of questions to ask each and every one of them. What emerged was a comprehensive product of the Who’s Who in workers’ compensation. The Most Influential didn’t just list a name and an affiliation; it gave answers to some of the most pressing California workers’ comp questions of the time and provided a glimpse into the future.

Reporters: Bess Shapiro, Jack Duffy, Paul Stremple

Contest: Specialized Information Publishers Association

Category: Best Reference Publication or Directory

Place: 2nd

The Most Influential People in California Workers’ Compensation for 2010

When a state agency decides to contravene the intent of the Legislature, its big news and Workers’ Comp Executive got the story first when the Division of Workers’ Compensation’s (DWC) decided it was not going to update the permanent disability rating schedule (PDRS). The PDRS sets benefit award levels for workers who are permanently disable by an industrial injury. DWC officials began the process of updating the schedule in 2008 ahead of a January 1, 2010 deadline, but never completed the process. WCE was the first to get DWC officials to say on the record that they would not be updating the PDRS. The story enough buzz to prompt a formal inquiry by the Assembly Insurance Committee and the Senate Labor and Industrial Relations to the administrative director of DWC asking why the PDRS had not been updated. This resulted in the convening of an oversight hearing by the Senate Insurance Committee demanding answers from the administration and information from the industry.

When a state agency decides to contravene the intent of the Legislature, its big news and Workers’ Comp Executive got the story first when the Division of Workers’ Compensation’s (DWC) decided it was not going to update the permanent disability rating schedule (PDRS). The PDRS sets benefit award levels for workers who are permanently disable by an industrial injury. DWC officials began the process of updating the schedule in 2008 ahead of a January 1, 2010 deadline, but never completed the process. WCE was the first to get DWC officials to say on the record that they would not be updating the PDRS. The story enough buzz to prompt a formal inquiry by the Assembly Insurance Committee and the Senate Labor and Industrial Relations to the administrative director of DWC asking why the PDRS had not been updated. This resulted in the convening of an oversight hearing by the Senate Insurance Committee demanding answers from the administration and information from the industry.

Reporter: Brad Cain

Contest: Newsletter on Newsletters

Category: Best Deadline Reporting

Place: 1st

http://www.wcexec.com/No-Timely-Update-For-PDRS-Schedule.aspx

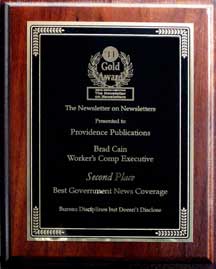

C ontinuing its fine tradition of acting as the industry’s watchdog, Workers’ Comp Executive discovered that the Workers’ Compensation Insurance Rating Bureau was not operating in a transparent manner. WCIRB is responsible for ensuring that workers’ compensation carriers report accurate information about the California market. Despite doing the business of the Department of Insurance, which includes consumers—in this case employers—the Bureau was managing to keep some of the people’s business under wraps. WCE revealed that WCIRB was disciplining workers’ comp carriers for various infractions of these reporting rules but would not disclose which ones were being disciplined or for what reasons.

ontinuing its fine tradition of acting as the industry’s watchdog, Workers’ Comp Executive discovered that the Workers’ Compensation Insurance Rating Bureau was not operating in a transparent manner. WCIRB is responsible for ensuring that workers’ compensation carriers report accurate information about the California market. Despite doing the business of the Department of Insurance, which includes consumers—in this case employers—the Bureau was managing to keep some of the people’s business under wraps. WCE revealed that WCIRB was disciplining workers’ comp carriers for various infractions of these reporting rules but would not disclose which ones were being disciplined or for what reasons.

Reporter: Brad Cain

Contest: Newsletter on Newsletters

Category: Best Government News Coverage

Place: 2nd

http://www.wcexec.com/articles/WCE00-20090324-003.html

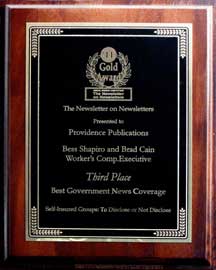

S elf-Insured groups or SIGs are groups of employers in the same industry that band together to provide workers’ comp coverage for their members. Each member is joint and severally liable for the members of the group should one of them go bankrupt. If one falls, they could all fall. Despite the fact that they act like insurance carriers, they are not held to the same standards as insurance companies. SIGs are not required disclose their financials to the public like insurance companies, despite being responsible for billions in payroll. A series of articles written by Workers’ Comp Executive detailing SIG vulnerabilities proved prescient. During 2009, the self insured groups run by group administrator CRM started closing as membership began to flag. The following year Workers’ Comp Executive broke the story about the failure of CRM’s Contractors Access Program Self Insured Program, the first self-insured group in California to fail. The result was millions in liabilities left with small employers. This was despite assurances from the SIG community that California had some of the toughest regulations and administration.

elf-Insured groups or SIGs are groups of employers in the same industry that band together to provide workers’ comp coverage for their members. Each member is joint and severally liable for the members of the group should one of them go bankrupt. If one falls, they could all fall. Despite the fact that they act like insurance carriers, they are not held to the same standards as insurance companies. SIGs are not required disclose their financials to the public like insurance companies, despite being responsible for billions in payroll. A series of articles written by Workers’ Comp Executive detailing SIG vulnerabilities proved prescient. During 2009, the self insured groups run by group administrator CRM started closing as membership began to flag. The following year Workers’ Comp Executive broke the story about the failure of CRM’s Contractors Access Program Self Insured Program, the first self-insured group in California to fail. The result was millions in liabilities left with small employers. This was despite assurances from the SIG community that California had some of the toughest regulations and administration.

Reporters: Brad Cain & Bess Shapiro

Contest: Newsletter on Newsletters

Category: Best Governmental Coverage

Place: 3rd

CRM Confirms Auto Group’s Closure

Will Scrutiny Screw the SIGs

Self-Insured Groups Play Hide the Data Discussions May Eviscerate SIG Disclosure Bill

CHSWC Study Says Full Disclosure Not Necessary

The Virtue of Selfishness: Let Competitors Peek

Legislature: SIG Transparency Still Controversial

2010

When there was no budget and no money, Governor Arnold Schwarzenegger decided that the sale of State Compensation Insurance Fund would bring some quick cash to the state coffers. The only problem was that the scheme was hatched behind the scenes and may have violated the constitution. WCE revealed before a bill even came out in print, the machinations behind the bill. This included the fact that the insurance commissioner would have no say in the transaction and that the State Fund board of directors would have no choice but to comply with the sale. The revelations helped stall the plan, which has never been revived.

When there was no budget and no money, Governor Arnold Schwarzenegger decided that the sale of State Compensation Insurance Fund would bring some quick cash to the state coffers. The only problem was that the scheme was hatched behind the scenes and may have violated the constitution. WCE revealed before a bill even came out in print, the machinations behind the bill. This included the fact that the insurance commissioner would have no say in the transaction and that the State Fund board of directors would have no choice but to comply with the sale. The revelations helped stall the plan, which has never been revived.

Reporter: J Dale Debber

Contest: Specialized Information Publishers Association

Category: Best Spot/Exclusive Single News

Place: 3rd

http://www.wcexec.com/SCIF-SALE-It-Might-Happen.aspx

2009

Workers’ Comp Executive got wind that a big retailer was about to go belly up, but the Office of Self-Insured Plans, the regulator of self-insured employers had failed to obtain a security deposit. When Brad Cain found out that Mervyns changed its bankruptcy filing from reorganization to liquidation, OSIP found it would have to payout bout $3.4 million a year to cover $20 million in workers’ comp claims that should have been covered by the deposit. The story exposed a glaring hole in the regulation of self-insured employers in California and showed how other employers in California can end up footing the bill. Workers’ Comp Executive as ahead of the story before anyone else.

Workers’ Comp Executive got wind that a big retailer was about to go belly up, but the Office of Self-Insured Plans, the regulator of self-insured employers had failed to obtain a security deposit. When Brad Cain found out that Mervyns changed its bankruptcy filing from reorganization to liquidation, OSIP found it would have to payout bout $3.4 million a year to cover $20 million in workers’ comp claims that should have been covered by the deposit. The story exposed a glaring hole in the regulation of self-insured employers in California and showed how other employers in California can end up footing the bill. Workers’ Comp Executive as ahead of the story before anyone else.

Reporter: Brad Cain

Contest: Specialized Information Publishers Association

Category: Best Spot News

Place: 2nd

http://www.wcexec.com/articles/WCE00-20081103-003.html