There is a growing concern about workers’ comp claims handling problems among self-insured employers in California. Much of the hard data is not publically available and officials at the Office of Self Insurance Plans are statutorily prohibited from discussing specific self insureds, but they disclose auditors are finding more problems in some specific areas of the claims handling process.

Claims Denial

Specifically, the agency says it is finding more instances of workers’ comp claims being closed prematurely – and in at least one case it found an employer that was denying claims at more than three times the industry’s average rate. Instances of improper claims closures and denials are also linked to underfunding of workers’ comp reserves and security deposits.

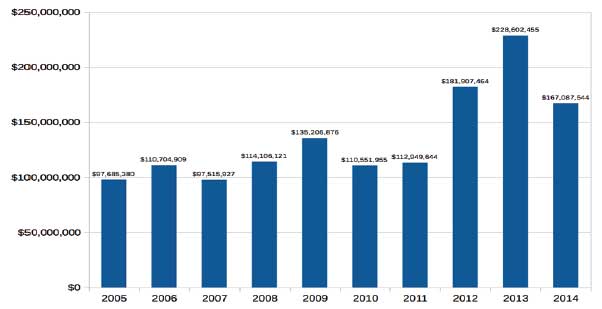

Audits in the last three years have found nearly $600 million in estimated future workers’ comp liabilities that employers were not reporting (see chart). It’s unknown, but also likely that the under-reporting creates underfunded reserves and security deposits as well.

OSIP is under new leadership. Lyn Asio Boz is currently serving as acting chief of OSIP.

OSIP is under new leadership. Lyn Asio Boz is currently serving as acting chief of OSIP.

Many of the problems, according to OSIP, appear to be with employers that were formerly self-insured but are now in the insured market. Formerly self-insured employers are still financially responsible for the workers’ comp claims they incurred while they were legally self-insured.

Marilee Robinson, audit supervisor for OSIP, says that in the past these employers were typically only audited when their self-insurance certificate was pulled if even then. She says the agency is only now looking at claims from these employers and – not surprisingly – is finding problems.

“I don’t know if it is true, but some people seemed to think that we were never going to come back again, and the claims files tended to fall by the wayside,” Robinson says. Now she says the agency is taking a look at all of the revoked certificate accounts. Of the ones that have been audited so far, Robinson says that a lot of the problems have to deal with the premature closure of claims.

“Proper closure of claims has become a problem that we’re seeing a lot recently,” says Robinson. “Premature closing of claims leads to underestimating the estimate of future liability, and the actual cost of the claim is affected, and the deposit is affected.” (see chart).

DIR officials did not answer questions about the total population of revoked certificates that have been audited to date and how many are still to be reviewed. They also have not divulged any information about how many prematurely closed claims have been found during the audits performed to date beyond describing the total as “a lot.”

Two-Year Rule

The state has fairly straight forward rules on when a claim can be closed. OSIP’s Robinson notes that the two-year rule provides that a claim where the injured worker is entitled to future medical benefits cannot be closed unless no benefits have been paid in the last two years.

Robinson notes that this provision applies to all benefits including permanent disability, temporary disability, and any medical treatment or services. The OSIP auditor also notes that under Labor Code section 15400.2, claims must be kept open beyond this two-year window if there is a reasonable expectation that future benefits will be claimed or provided.

“If there is a likelihood that somebody will need medical treatment then you cannot close the file,” she says, noting that this deals particularly with cases involving hearing aids that need replacement every few years or joint replacements that will eventually need replacing. “You know that somewhere down the line whether its 10 or 20 years if they’ve had a hip or knee replacement that is something that is going to happen so you need to keep the file open with the appropriate reserves,” she says.

Robinson also points out that claims files cannot be closed if there are still outstanding liens on the claim.

BBSI Linkage?

It is unknown if the on-going and growing problems afflicting Barrett Business Services’ (Nasdaq: BBSI) workers’ comp program are linked to these latest findings from OSIP (see related story on page 1). Company officials did not respond to a request for comment. Barrett’s self-insurance certificate was revoked effective Jan. 1, 2015. And it had to borrow money to bond some $80 million in reserves it was underfunded.

In recent conference calls with investors, Barrett’s now former chief financial officer James Miller touted the professional employer organization’s (PEO) prowess in closing out its self-insured workers’ comp claims. During a call with investors about its third-quarter results, Miller told investors that BBSI has closed over half of the workers’ comp claims from 2012 and prior that it had been forced to strengthen reserves for in 2013. He says the closures produced nearly $9 million in reserve releases.

“Specifically, we are seeing continued trend of claims from years 2012 and prior closing for less than the amount put up on these specific claims. The significance of the 2012 and older claims is that they are now well seasoned and having been fully strengthened provide us with a solid basis for analyzing the development of claim years 2013 through 2015,” Miller said at the time. “The number of total open claims from 2012 and prior is now less than 800.”

On the other hand, Miller was terminated earlier this month for falsifying the company’s financial reports and under-reporting its 2013 workers’ comp expenses by $12 million. The company is launching an investigation to determine if there are other financial reporting irregularities and is looking back as far as 2011.

BBSI is also in the process of restating its loss adjustment expenses. The company recently revealed that it was not reserving for future medical cost containment expenses and instead was booking its MCC costs only as they were incurred. Accounting rules require companies to estimate the fees that will be accrued. The result is that Barrett will increase its 2013 and 2014 workers’ comp costs by a combined $1.3 million, and it will have to account for another $7.9 million linked to claims from 2012 and earlier.

In addition, Barrett is in the process of restating its June 30, 2014, and September 30, 2014, consolidated financial statement to recognize the $80 million workers’ comp reserve charge earlier than initially reported. The company says the charge will be moved to the second quarter financial report. The restated third quarter 2014 results will also include a $3 million reserve increase to cover unallocated loss adjustment expenses that it would incur if it stops administering workers’ comp claims.

Improper Denials

“One of the things that has come up is the denials,” says OSIP acting chief Lyn Asio Boz, noting that the agency is often called upon to investigate allegations by an injured worker or an applicant attorney that a legitimate claim is being denied. “The latest [investigation] that we did we found that yes the claim was improperly denied, it was fully documented that the injured worker was injured.”

Boz says the findings prompted a deeper look at the employer’s other claims denials that revealed a much broader problem. “That’s where we found that their denial rate was like 30% when the norm is like 9%,” she says. “In that particular instance, we referred the employer to the DWC audit unit for review of the denied claims and assessment of penalties.”

OSIP’s Robinson notes that when claims are not denied properly, it leads to increased litigation, under estimation of future liabilities inadequate security deposits and under-reserving. She also notes that it undermines the integrity of the employer’s annual report to OSIP.

In the case of this rogue employer, she says much of this was born out in the audit. “Through that whole process we found out that their workers’ comp reserves were real bad,” she noted.

DIR officials would not disclose the identity of the employer and declined to provide any further detail citing the on-going nature of its investigation.