Ties between embattled Insurance Commissioner Ricardo Lara and the industry he is charged with regulating go back farther than previously reported – or than reported by any other media. Internal California Department of Insurance e-mails plus new details about Lara’s out-of-state travels shines a bright light on numerous meetings between the commissioner and executives from Applied Underwriters and its partners. But the fuller story is even more interesting.

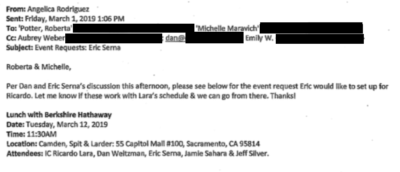

It is known that Eric Serna initiated a March 12th meeting between Lara and officials from Applied Underwriters including CEO Steve Menzies and legal counsel Jeff Silver (see e-mail image). Serna is general counsel with NTG Consultants. Notably, Serna is a former New Mexico Insurance Superintendent.

What the documents don’t show – and what Workers’ Comp Executive has exclusively uncovered – is that just days before the request was made, Serna and Lara were together at another confab in New Mexico on February 26. But wait, as the TV huckster says, there’s more!

Workers’ Comp Executive has also documented connections between Serna and Menzies.

Questions must be asked about the role Serna, who is not registered as a lobbyist in California, is playing in the whole affair.

The Feb. 26th meeting in New Mexico, combined with the March 1st meeting request and the March 12th luncheon mentioned in e-mails all occurred shortly after Berkshire Hathaway (NSYE: BRK.A) announced plans to sell Applied Underwriters to then undisclosed buyers. The sale announcement meant that numerous state insurance departments, including Lara’s, would have to sign off on the deal.

The meeting also occurred just four weeks before Lara deposited $46,500 in campaign contributions from individuals linked to Applied Underwriters but who were not identified as such. Lara was serving as his own campaign treasurer at the time and was responsible for vetting the donors. He had to know from whence the cash was coming and why.

Recent reporting by the Sacramento Bee revealed that while Lara was in New York in early April on state business, he and his then fundraiser Dan Weitzman held a previously undisclosed fundraising event. Weitzman is Controller for the California Dem party.

Recent reporting by the Sacramento Bee revealed that while Lara was in New York in early April on state business, he and his then fundraiser Dan Weitzman held a previously undisclosed fundraising event. Weitzman is Controller for the California Dem party.

A week later, checks for $46,500 from Stephen and Carole Acunto and Theresa DeBarbrie were deposited by Lara into his reelection campaign. Acunto sometimes serves as a spokesman for Applied Underwriters. Acunto owns New York-based Insurance Advocate magazine and his Beacon International Group recently purchased Business Insurance Magazine. Financial terms, including any financing arrangements, were not released.

DeBarbrie is married to a former Applied executive. The Acunto’s are New York residents, and DeBarbrie resides in New Jersey.

The Commissioner has since returned the questionable contributions and halted fundraising efforts at least through the end of this year.

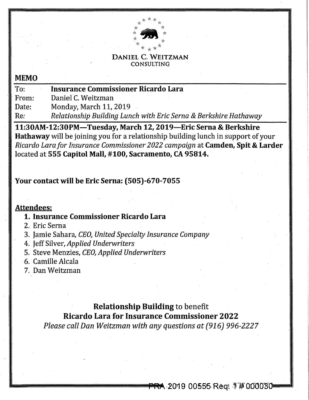

The March 12th meeting predates a May 6th meeting between Lara and Applied’s Menzies. Lara disclosed that meeting earlier this year in a bid to curtail the growing scandal. What Lara didn’t disclose is that United Specialty Insurance Company CEO Jamie Sahara was also in attendance. Sahara and Menzies are teaming up to buy out Berkshire Hathaway’s share of Applied for some $737 million. It was at least the second time the executives and Lara met.

Meeting Timeline

Serna originally requested the March 12th meeting between Applied and Lara through Dan Weitzman, Lara’s now-former fundraiser, according to internal Department of Insurance e-mails. Campaign discussions, fundraisers, or fundraising arrangements made via government e-mails are illegal.

Weitzman left his position with Lara earlier this year amidst the public outcry over the campaign contributions and the actions Lara and the Department have taken that favor Applied.

But attempting to make Weitzman the fall guy is likely not enough to save Lara according to some analysts. Editorials all over the state are wondering how long he will be able to stay in office.

Weitzman submitted the meeting request on March 1st, but new information indicates that the planning started earlier. Workers’ Comp Executive has confirmed that Lara and Serna were in close contact just days before Weitzman forwarded the meeting request to Lara’s staff.

Just three days earlier on February 26th, Lara and Serna were sharing a stage at a private event in Santa Fe, New Mexico where Lara traveled on the taxpayer’s dime. Lara was a featured speaker for the Somos un Pueblo Unido foundation’s annual gala. Serna helped officiate the event. The next day, Lara spoke at a Winter Regulatory Panel organized by New Mexico Superintendent of Insurance John G. Franchini to discuss wildfire and automobile insurance issues.

Workers’ Comp Executive has learned that Serna and Menzies also shared a stage at a fundraising dinner for the Santa Fe Children’s Museum this summer. Menzies was the guest of honor for the event, and Serna helped officiate

Relationship Building

The March 12th meeting was billed as a “Relationship Building Lunch” with Berkshire Hathaway officials to support Lara’s planned reelection campaign in 2022 (see photo). Technically, Berkshire officials attended — but only in the personage of Applied Underwriters’ Menzies and general counsel Jeff Silver. Applied is a Berkshire subsidiary but operates mostly independently under Menzies’ direction. Also in attendance was United’s Sahara, the other buyer. The arrangements were made over the Department’s e-mail system.

That same day, Applied General Counsel Jeffrey Silver e-mailed Emma Hirschhorn, Chief of the Financial Analysis Division, thanking her for meeting with Steve Menzies, Eric Serna, and himself regarding the “soon to be filed Form A for California Insurance Company.”

Numerous public records act requests have been made by Workers’ Comp Executive for copies of the public portions of the Form A filed with Lara’s California Department of Insurance. CDI has produced nothing. Lara’s Department will have to approve the deal which includes California domiciled California Insurance Company and Applied Underwriters Captive Insurance Risk Insurance Company.

The deal is supposed to close by the end of the month, according to the Iowa filing. If the September 30th date is accurate, expect some movement from CDI on Applied’s California filing any day.

But real questions still remain about the relationship between Ricardo Lara and Applied Underwriters’ money.

-30-

Applied Underwriters was once but is no longer an affiliate of Berkshire Hathaway. Applied’s management bought it. Berkshire Hathaway bears no responsibility for any of the events which have transpired involving Applied Underwriters’ or its subsidiaries including California Insurance Company.