The architect of an illegal workers’ compensation program that also sold fake Affordable Care Act hardship exemptions and ran a fraudulent pension scheme received a five-year prison sentence, and the head of finances for the operations received a two-year jail term. Federal Judge Dale A. Drozd also rejected their motions to acquit and for new trials.

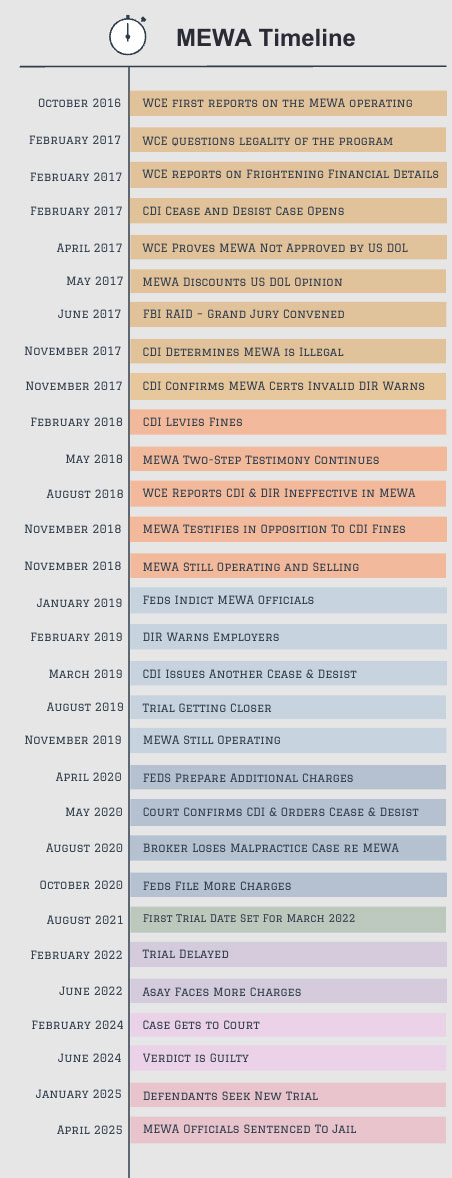

Sentencing in the case came nearly 9 years after Workers’ Comp Executive broke the story, exposed the fraud, and began its detailed investigative series about the MEWA in October of 2016. It took until January 2019 to get the first indictment and until February 2024 to go to trial, and a year more to work through post-trial motions and schedule sentencing. (See timeline).

Marcus Asay was convicted on all 18 counts the federal authorities brought against him for his role in running the Agricultural Contracting Services Association and its alter ego, the American Labor Alliance. Asay received the stiffer sentence, while Antonio Gastelum received a two-year term for his single conviction. The organization was also convicted and received a fine of $2.5 million, while Asay and Gastelum were each ordered to pay $69,250 in restitution.

“The court ordered Mr. Asay to report for his sentence on or before July 15, 2025, to allow the Federal Bureau of Prisons to review medical records and determine an appropriate institution to fulfill his medical needs. It denied his motion for bail during appeals,” says Assistant U.S. Attorney Michael Tierney. “The court granted Mr. Gastelum’s motion for bail during the appeals process, so he will not serve his sentence until and unless the United States Court of Appeals for the Ninth Circuit affirms the convictions and sentence.”

Asay is scheduled to go to trial in a separate income tax and Social Security Disability fraud case later this year. He is charged with filing false tax returns that omitted roughly $300,000 that was taken out of ALA for his personal use and with collecting $1,700 per month in disability benefits while earning $1,000 a month working for ALA. The trial was supposed to have started this week, but the parties agreed to push the trial back to October.

Underlying Convictions

Asay and Gastelum were convicted of pension fraud on June 18, 2024, nearly a year ago. They and the American Labor Alliance were also convicted for running the fraudulent workers’ comp program that operated as CompOneUSA and selling a fake hardship exemption to the Affordable Care Act’s requirement that individuals obtain health insurance or pay a fee for not having coverage. The government showed that it had no authority to sell such an exemption and that only the government could grant an exemption.

The defendants claimed the program was exempt from state regulation as an entity claiming an exception to the federal multi-employer welfare arrangement (MEWA) rules. The claimed legality of the program aside, which the court blocked arguments over, prosecutors showed that Asay and ALA misled employers by indicating that actual insurance companies were behind the fake workers’ comp certificates of insurance and policy declarations they were given. The program generated $2.25 million in premiums.

Evidence presented at trial also showed that the pension program defrauded more than 3,000 people. They were told that their investments in the pension fund would be held in trust and invested for them but that the defendants used the money for business and personal expenses. Federal officials say the defendants took over $750,000 from the pension fund to pay for travel, dinners out, rare coins, credit cards, and other personal expenses. Prosecutors say they covered up the missing funds by taking monies received through the workers’ comp scheme and holding them as pension funds.

The U.S. Attorney notes that Asay and Gastelum each received enhanced sentences because they both testified in their own defense, and the court found that they perjured themselves with their testimony.

Motions Denied

Judge Drozd issued a lengthy order denying the defendant’s motions for judgment of acquittal and a new trial. The motions partly argued that the clients benefited from what they bargained for and, therefore, there was no fraud.

“[A]s to the workers’ compensation insurance program, there was evidence introduced at trial that defendants ALA and Asay represented to the purchasers that the program was materially different (as in, backed by national insurance companies) than it actually was,” noted the court in the order. “That the victims received some degree of coverage, e.g. coverage provided solely by ALA as a self-insured, does not demonstrate that the defendants did not have the intent to defraud.”

Note: ALA was not a permissively self-insured entity, and the Judge’s comments were because ALA did pay some claims itself.

Similarly, the court rejected the argument that there was no harm or foul with the pension program because the investors were paid back with interest. “The court rejects the notion that later repayment of the funds with interest somehow prevents defendants from having had the ‘intent to defraud,’ since the fraud would have been complete at the time that false statements were made that caused people to part with money,” Drozd wrote.

The Judge also rejected the argument that there was no fraud related to the hardship exemption because none of the purchasers were ever penalized for not having health insurance. “That the government did not require victims of this aspect of the fraud to ultimately pay penalties for not having the required health insurance does not mean that the evidence was insufficient to establish that defendants made a misrepresentation going to the nature of the bargain,” the order notes.

Note: California industrial relations authorities did not penalize employers nor issue stop-work orders for not having workers’ compensation insurance despite clear evidence and a list of over 300 employers in the program. The California Department of Insurance likewise took no action against agents or brokers selling the program, although several were identified as a replacement for workers’ compensation because, they said, it was not insurance. Therefore, they had no jurisdiction. CDI took action against the MEWA, although it couldn’t stop it.

Copies of the court’s order denying the motions for judgment of acquittal and a new trial are available in our Resources section or by clicking here. The court has not posted the final sentencing order yet.

Our entire archive of the investigation can be found here.