Insurance Commissioner Ricardo Lara will hold a hearing next month to review the insurance industry’s request for a 2.7% increase in California’s workers’ comp advisory pure premium rates. At the same hearing, Commissioner Lara will hear a counterargument by employers and organized labor that rates should decrease by 8.2%. The difference is 10.9%.

All of this comes against a backdrop of record profits for carriers in workers’ comp, loss ratios in the 80s, and significant reserve redundancies.

The Bureau tried to impose a COVID surcharge on all California employers no matter their likely exposure, last year but the Commissioner did not approve it. The Bureau also added a class for stay-at-home workers last year but refused to promulgate a rate for it despite the experience of most other states showing the rate at one-quarter to one-third of the rate for clerical office. It has not offered a rate for the class this year either.

Many employers are facing a tough time because of the government’s COVID shutdowns. California has far more stringent rules for businesses than other states.

Employers, brokers, and other interested parties can add their voices to the debate through the public comment period, which is already open. Details about how to submit comments are below.

The California Department of Insurance scheduled the rate hearing for June 7th and will hold the hearing online. The public comment period runs through the end of business that day. Sometimes the comment period is extended to allow for the submission of additional testimony. In the past, the Department extended the public comment period to allow time for the Workers’ Compensation Insurance Rating Bureau to gather information or form a response to questions raised by the Department.

The Bureau is a private organization with quasi-governmental responsibility. It is financially supported exclusively by insurance carriers in whose interests it operates.

The Arguments

The WCIRB argues that new fee schedules and the impact of the economic recovery from the COVID-19 pandemic drive the need for a rate increase. Updated payment rates for the med-legal fee schedule (MLFS) and the evaluation and management (E&M) section of the Official Medical Fee Schedule boost rates by 1.5%.

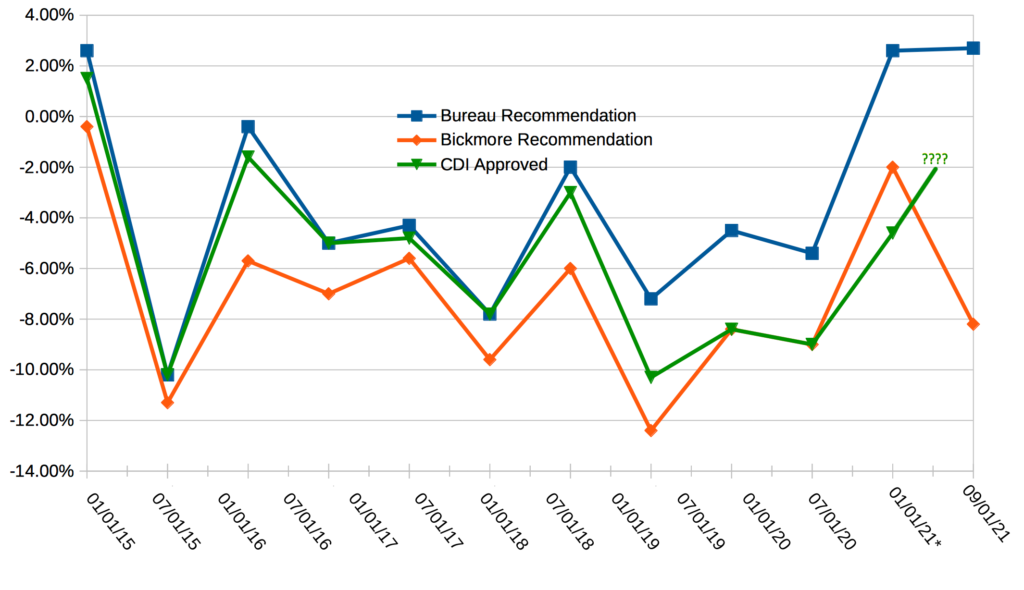

Bickmore actuary Mark Priven represents the public employer and labor members on the Bureau’s Governing Committee and has a different outlook on claim frequency, which drastically lowers his rate projection. He is also less pessimistic on the issue of medical inflation. He shows the Bureau has repeatedly over projected the rate of inflation. Since rates began falling in 2015, Priven’s recommendations have consistently been closer to the mark on how much costs will actually decline. The Bureau consistently recommended a smaller decrease or even an increase in rates each time. But subsequent evaluations reveal that rates should have been cut even deeper (see accompanying graphic).

The Bureau tried for an increase last year of 2.6% after proposing a COVID-19 surcharge on every insured employer in the state. Absent the average 6 cent surcharge, the Bureau’s filing was for a 1.3% decrease in the advisory pure premium rates. Bickmore’s recommendation was for a rate decrease of 2%, even with COVID costs added to his rate projection. Priven’s base rate without a surcharge was a 5.3% rate cut. Commissioner Lara rejected both Bureau’s surcharge and the Bureau’s methodology and ordered a 4.6% rate cut for the advisory rates.

How To Voice Your Opinion Contact Information

The Department encourages public participation. Communications are accepted either by snail mail or by email. Attachments are accepted in either format. All correspondence should use the reference number, which is REG-2021-0003. If you are emailing, please add that to the subject line.

Comments can be emailed to CDI attorney Brentley Yim at Brentley.Yim@Insurance.ca.gov or snail-mailed to him at 1901 Harrison St., 4th Floor, Oakland, CA 94612.

The rate hearing is scheduled to begin at 10 a.m. June 7th. Details on how to join are in the hearing notice, which is available in our Resources section or by clicking here.