The California Department of Insurance is considering increasing a proposed $3.4 million penalty against American Labor Alliance and the officials behind the purported alternative to workers’ comp insurance. The penalty is for allegedly defying the two-year-old cease and desist order the California Department of Insurance issued against it for operating without an insurance certificate.

But the MEWA people have ducked and dodged and ended old entities and began new ones and fines may not be collectable unless the Feds step in.

The Department’s administrative hearing bureau is now reviewing information that officials behind the apparently illegal programs are continuing to operate much as they did before – albeit under a new guise.

The Department is not saying if it will issue a new cease and desist order against the purported alter ego that was set up – Omega Community Labor Association and Compass Pilot benefit program – that are continuing to sell and administer the same type of benefits, again without any California authority.

“It appears they just rebranded themselves. Started a new company working out of the same addresses with the same people and that they’re continuing to operate in a very similar manner as American Labor Alliance,” said CDI investigator Thomas Johnson on the witness stand. He testified that since November when the precedential order came down, American Labor Alliance appeared to stop marketing and selling the workers’ comp benefit and that these efforts shifted to Omega and the Compass Pilot program.

ALA claimed to be an “entity claiming exemption” (ECE) that under the Federal Employee Retirement Income Security Act (ERISA) rules was exempt from state regulation as a multiple employer welfare arrangement or MEWA. Omega is claiming the same. Officials testified that they were selling workers’ comp benefits, not insurance, but then issued standard insurance industry certificates of liability coverage. In some cases, it even issued certificates to employers that listed insurance policy numbers that were for policies ALA purchased for itself from admitted carriers, according to the Department.

ALA officials are challenging the penalty, but at times were less than forthcoming in their responses to questions from the administrative law judge hearing their appeal. ALJ Kristin L. Rosi is handling the case. She also handled the original complaint against ALA and issued the decision finding ALA and CompOneUSA to be an illegal operation. Insurance Commissioner Dave Jones adopted Rosi’s findings and made the decision precedential last November.

Shortly after the decision came down, CDI investigator Johnson testified that he was tipped off that two new companies – Omega Community Labor Association and Compass Pilot – were now operating and taking on much of the business that was formerly in the illegal program. The new companies share addresses and founding officers with ALA and CompOneUSA.

Johnson testified that his investigation revealed that former ALA clients were told to have their employees sign new registration cards with Omega, but that they were to continue paying CompOne until the cards were signed. He testified that other former clients reported being contacted by their ALA rep after the cease and desist order was upheld and were told of the new program. The CompOne contact would remain the contact for the new Compass Pilot program.

Reluctant Witnesses

ALA’s Marcus Asay and finance officer Antonio Gastelum both testified that the plans for Omega and Compass Pilot were put into action through the second half of 2017, but that the effort intensified last November. It was in November that CDI issued its precedential decision finding that ALA and CompOneUSA were operating illegally.

This operationalization of Omega has continued not just into 2018, but it appears to have continued up to the very moment of ALA’s appeal hearing before the Department. Both executives though had trouble on the stand remembering timelines and details about the operation without additional probing by ALJ Rosi or the Department’s prosecuting attorney.

To bolster its assertion that Omega is a legitimate union offering ERISA benefits, Gastelum made note on the stand that it has an M-1 on file with the U.S. Department of Labor. An M-1 form is the annual report filed by multi-employer welfare arrangements and entities claiming exception (ECE) — which is what Omega is claiming to be as did ALA. CDI’s investigator testified that he had searched for an M-1 but found nothing as recently as two weeks before the hearing.

Noting the Department’s testimony, Rosi asked Gastelum when they made the M-1 filing. His answer was less than candid.

“I don’t know specifically, again it would have been between November and today,” Gastelum testified under oath. Drilling down on the timing of the M-1 filing, Judge Rosi rephrased the question. “Do you think [the filing] was within the last two weeks?” Gastelum replied simply “Yes.”

A review of Omega’s M-1 on file with the Department of Labor shows that it was signed by Gastelum under penalty of perjury on April 26, 2018. There was no timestamp on the M-1 form, but at 1:20 p.m. on April 26, 2018, Gastelum was on the stand testifying under oath that he could not recall when the filing was made.

Newly Formed Federation

Gastelum provided financial services to American Labor Alliance and its CompOneUSA program and testified that he is under contract to provide back office and financial services to Omega. The contract is through a newly formed company that is run by Asay – World Workforce International.

Asay described WWI as an international federation of labor organizations and says it has four member unions in the United States. Under questioning from attorney Teresa Campbell, chief of CDI’s San Francisco Enforcement Bureau, Asay said he could not say how many of the four unions operated in California. At least not without further prodding.

“At least two of them – we’ve identified ALA and Omega – as members of World Workforce correct,” asked Campbell.

“At least two of them – we’ve identified ALA and Omega – as members of World Workforce correct,” asked Campbell.

“I’ll answer this way. I could go to my membership department, and I could ask them for the statistics and for the numbers. I don’t have them off the top of my head,” Asay replied.

Pressed further, Asay responded that three are operating in California. In addition to ALA and Omega, the third is Women’s Workforce Federation. The fourth union, Firestone, is in Texas.

Asay also testified that World Workforce was formed last year and was incorporated in Delaware. Delaware records indicate that World Workforce International was incorporated on August 4, 2017.

Judge Rosi questioned whether WWI had filed a statement of foreign corporation in California to do business here and Asay replied that he did not believe it had done so. “And it’s not incorporated in California?” asked Rosi. “It is not,” Asay replied.

What was left out of this exchange was that one week earlier World Workforce International of USA, LLC was incorporated in California on April 19, 2018. Marcus Asay is listed as manager of the LLC, and it was Asay who signed the statement with the California Secretary of State. He listed his title as “chair.” He made no mention of this activity during questioning by Judge Rosi while he was under oath.

California Members

Gastelum testified on the stand that Omega has about 300 collective bargaining agreements that include the Compass Pilot workers’ comp benefit but testified that he could not say how many came from the ALA/CompOne program.

The company’s newly minted M-1 filing says they have 7,000 members.

Gastelum testified that he could not provide a date when Omega became fully operational but says it was created to “ensure seamless participation in the benefit program these employees and employers were relying on that were put in jeopardy by being associated with ALA.” He testified that CompOne’s operations were suspended immediately when they received the Department’s November decision as Omega was being operationalized.

Gastelum said that part of the process to get Omega operationalized was getting “agreements documented and memorialized between Omega and ALA, for example, or CompOne, to document the transfer of liabilities and assets that were being assumed by Compass Pilot, by Omega, in order to service the participants that qualified to continue or to start receiving benefits through Omega.”

Exactly what liabilities or assets were included in these agreements was not disclosed. During the earlier hearing into ALA’s operations officials testified that CompOne did not maintain case reserves and was paying claims out of its cash flow. They also testified that CompOne was started without any initial capitalization.

The earlier hearing also produced evidence that ALA was collecting the assessments that employers pay to fund the Department of Industrial Relations and the California Insurance Guarantee Association even though it was not authorized to collect the assessments and had no mechanism for forwarding them to either organization. It was not discussed during the appeal hearing whether Omega and Compass Point have continued this practice.

During the latest hearing, it did come out that ALA and Omega have a claim shop in Clovis that handles benefit administration. DWC officials confirm that Compass Pilot and CompOneUSA filed the necessary paperwork to be listed as a claims administrator in the state’s workers’ comp system. Neither entity, however, has ever filed a report on their claims activity with the state.

DWC notes that California Code of Regulations, title 8, section 10104 requires claims administrators to file, by April 1 of each year, an annual report of inventory (ARI) with the DWC administrative director (AD) indicating the number of claims reported at each adjusting location for the preceding calendar year. Even if there were no claims reported in the prior year, the report must be completed and submitted to the DWC Audit Unit. Each adjusting location is required to submit an ARI, whether or not it receives a form for reporting claims from the Audit Unit unless its ARI requirement has been waived by the AD.

The shops have never been audited, according to state officials.

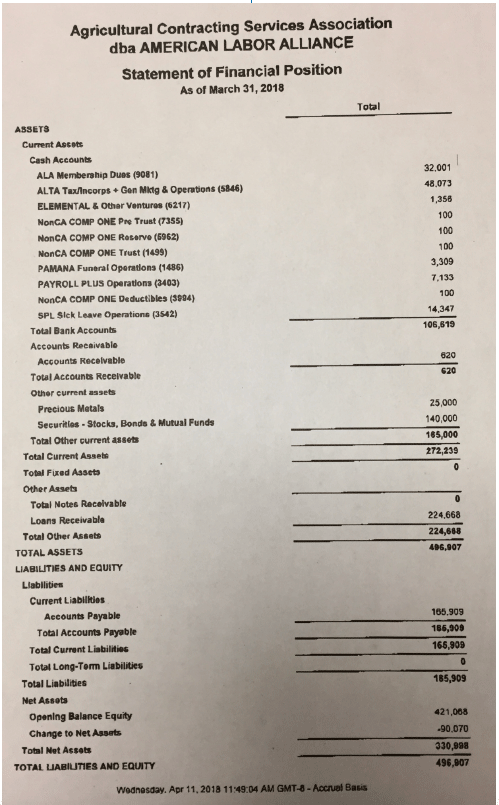

A decision in the latest case is not expected until late Summer. In the meantime, additional fines of $5,000 a day may be accruing on top of the proposed $3.4 million penalty, depending on the final decision in the case. ALA submitted into the record, however, a March 31, 2018, financial statement claiming to have total liabilities and equities of less than $500,000. Marcus Asay’s financial information was also submitted, but it was sealed.